The Single Strategy To Use For Offshore Wealth Management

Table of Contents5 Simple Techniques For Offshore Wealth ManagementOffshore Wealth Management Can Be Fun For AnyoneSome Known Incorrect Statements About Offshore Wealth Management Rumored Buzz on Offshore Wealth Management

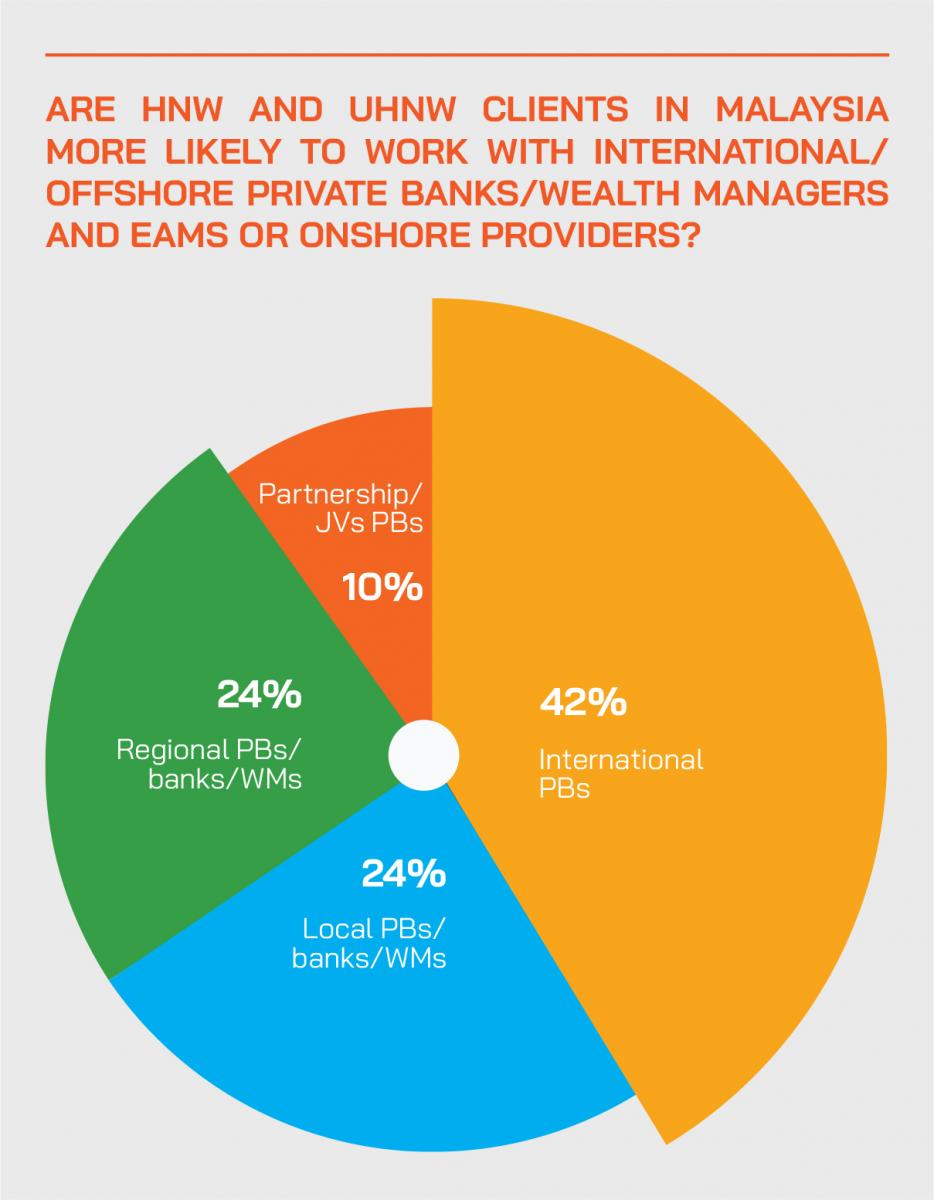

A winning mix, therefore, is commonly a mix of a solid regional player which has the client understanding and also physical visibility, paired with an offshore player that gives the table the processes and also systems to assist this. Some care is, nonetheless, necessary for overseas exclusive banks. They will have a tendency to have a much better exposure to supposed tax-haven danger, offered the variety of tax obligation jurisdictions and also guidelines the demand to adhere to.

Instead, the emphasis should get on the organization design. This indicates tackling some difficult concerns, such as exactly how personnel are awarded; the financial investment development approaches; just how and just how much consumers are billed; and whether the marketplace typically, and the monetary institutions and also their consumers, are all set to alter the means they function. offshore wealth management.

For the time being, at the very least, international personal financial institutions as well as riches hubs such as Singapore and Hong Kong, stay aspirational modification representatives as fad leaders which set the regional wealth administration criteria.

As a deportee there are a number of points you'll require to think of, yet your funds ought to go to the top of the listing. It is very important to have actually a tailored riches management strategy that can aid you prepare for the future, and spending offshore can be a terrific method to do that.

The Ultimate Guide To Offshore Wealth Management

Consent * I wish to get normal insights.

Our partners are carefully picked from amongst the leaders in their field, to supply solutions that enhance our wide range advising technique as well as enhance your worldwide way of living (offshore wealth management).

Facts About Offshore Wealth Management Uncovered

Below's an intro to overseas investments as well as the main points to keep in mind. For a UK capitalist, an overseas financial investment is one that holds your cash outside the UK. It may be a fund that purchases international firms, or equally it might purchase British business however just be registered abroad.

If a fund is registered outside the UK, it might be subject to different or lighter guideline than a UK fund. It may additionally have accessibility to a bigger range of investments and also monetary items. This can develop more chances for creating higher returns although at the same time it might subject your money to greater risk.

This suggests that these offshore funds reinvest development without paying tax obligation, which can boost their rate of return. This may not aid you straight as a UK-based capitalist (as you are still strained the very same on any type of revenue), this setup can save money for the fund business itself, which might pass on some of the financial try this web-site savings in larger returns and/or reduced monitoring costs.

If the country where you are staying has inadequate financial guideline, you might prefer financial investment funds based in more regulated territories. Numerous people assume that spending overseas is regarding paying much less tax.

Excitement About Offshore Wealth Management

That is, your financial investments might grow faster in a low-regulation environment yet equally, they might decline equally as sharply. Regulation works both means, because while it might cause slower development, it additionally supplies even more safeguards to you, the financier. When you attach a fund that's signed up outside the UK, you forfeit the defense used by residential laws in favour of a various setting.

The risk entailed in any offshore fund depends mainly on the companies in which it invests, and also on the nation where it is registered. Simply put, research study each one on its own benefits prior to making any kind of choices. Offshore investing is a lot more common than you may think several pension plan funds as well as financial investment funds have some offshore components in them - offshore wealth management.

Offshore financial investments are created with the goal of: Giving you with accessibility to a broader range of asset classes and also money, resource Permitting regular investment or as a one-off swelling sum, Increasing the development possibility of your financial investment, Spreading out the danger of your investment, Using you access to seasoned and also experienced specialist fund managers, Offering you the choice of a routine and predictable 'income'Allowing you to change between funds easily, Aiding you to potentially minimize your obligation to earnings and funding gains visit this web-site taxes Offshore financial investments can be an appealing alternative in situations where: funding is reserved for a minoryou anticipate your low price of tax to drop you are entitled to an age-related allowanceyou are an expatriate or are non-resident in the UKFor more details, specific to your scenarios, please contact us to review your requirements, as the details offered is based upon existing regulations as well as HM Revenue & Customs practice as well as does not amount to tax preparation guidance.